Introduction

Risk Integrated has extended its well proven Specialized Finance System (SFS) to include equity risk metrics for commercial real estate. Over the last 16 years the SFS has been developed primarily to provide credit risk metrics such as probability of default and stress-loss for commercial mortgages using cashflow simulation. The credit metrics are based on the cashflows to the loans whereas the equity metrics are the 'residual' cashflows to the property owners and include the effects of leveraging, interest rate swaps and currency effects for multi-currency portfolios.

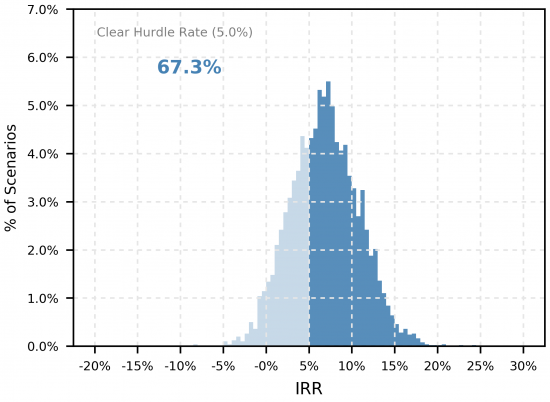

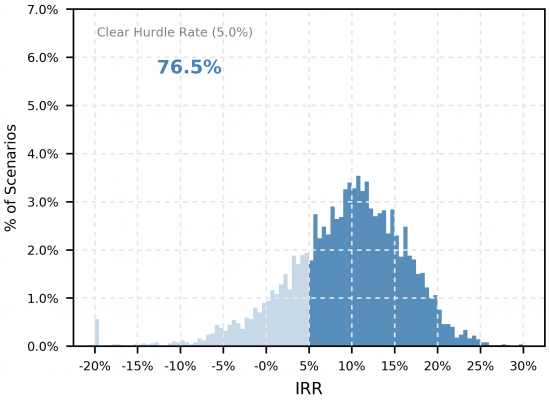

For equity investors the SFS produces familiar metrics such as the internal rate of return and cash on cash return, in both the base-case and across thousands of possible market and tenant scenarios. The figures below illustrate the IRR for a deal without and with leverage.

Returns without Leverage

Returns with Leverage

The links below give the complete reports for the deals without and with leverage, and include the credit report on the debt for the leveraging loan.

- Equity Report for Unleveraged Property Investment

- Equity Report for Leveraged Property Investment

- Credit Report for the Leveraging Loan

Dr. Chris Marrison

CEO, Risk Integrated

Chris.Marrison@RiskIntegrated.com

Contact Risk Integrated today

Want to learn more about this article? Speak to our experts today.

Contact Us