RISK ANALYTICS OVERVIEW

Our Models Account for the Complex Interaction between the Properties and the Financing Package

Risk models should help foresee future possible outcomes to improve decision-making. Common risk models estimate a general level for the risk, but do not take into account the changing interaction of risks over time. The SFS provides the detailed "fingerprint" of the risk profile over the life of the loan, helping to identify and structure around future peaks in risk.

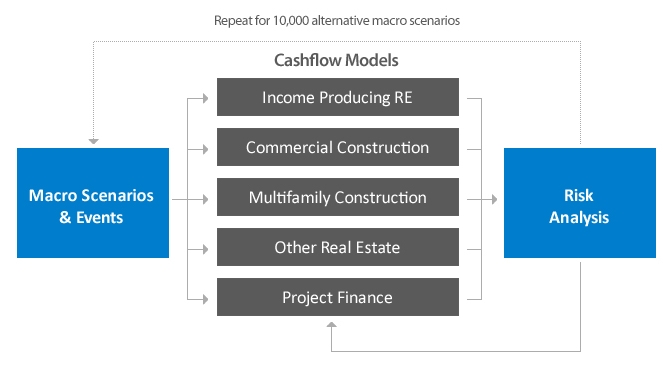

The cashflow models, which serve as the building blocks of the SFS, cover equity, senior, junior and mezzanine loans to companies whose primary business is the ownership or construction of infrastructure and commercial properties.

The methodology randomly creates future possible paths for market and economic conditions, and then subjects the cashflows to those conditions. In addition to the cashflows being conditional on theses systemic risks, the approach allows idiosyncratic risks such as tenant defaults or failures to re-let units after lease expirations. Integrating across several thousand scenarios gives the statistics for default and loss per year.

The risk models allow up to twelve levels of seniority and carefully considers all features of a loan, taking into account the impact of variations in:

- Lease structure

- Collateral value, including non-CRE collateral

- Amortization structure

- Rate structure

- Sweeps and covenants

- Construction costs

- Tenant credit worthiness

- Vacancy events

- Refinancing risk

- Interest derivatives

The statistics module calculates risk statistics for individual transactions and portfolios of transactions, including all the standard risk metrics:

- Probability of Default

- Expected loss

- Loss Given Default

- Unexpected loss

- Downturn LGD

- Maximum probable loss

- Economic capital

- NPV of loss

The underlying risk models are in an open form that allows the customers' experts to easily view all the assumptions, parameters and calculations used in the model. Full documentation and training is also given. Customization of the models, if required, can be performed by Risk Integrated or the customers' specially-trained staff.