FOR IMMEDIATE RELEASE:

Risk Integrated Releases Quarterly CCAR Model for Commercial Real Estate

New York / London – May 19, 2016 – Risk Integrated, the leading international risk solution provider for commercial real estate, today announced the release of a quarterly cashflow simulation model (CFM) specifically tailored to the requirements of the US regulatory Comprehensive Capital Analysis and Review (CCAR) stress tests. In addition to breaking the risk into granular, quarterly time steps, this new model requires less input data and is easier to use and maintain.

The CCAR CFM is built on the same foundation as the comprehensive fully detailed CFM that clients are currently using in the Specialized Finance System (SFS) for grading and deal structuring as well as Basel III and Solvency II regulatory compliance. The full model takes into account the many features, such as covenants, lease terms, etc., which can change the risk of a commercial real estate financing, and are especially useful when structuring new credits. By building on the same foundation, the new CCAR CFM model leverages the proven track record of the full model (see Validation of the Specialized Finance System). However, the CCAR CFM has been optimized and greatly simplified such that it only requires data which is available from the CCAR dataset (the FR Y-14Q data).

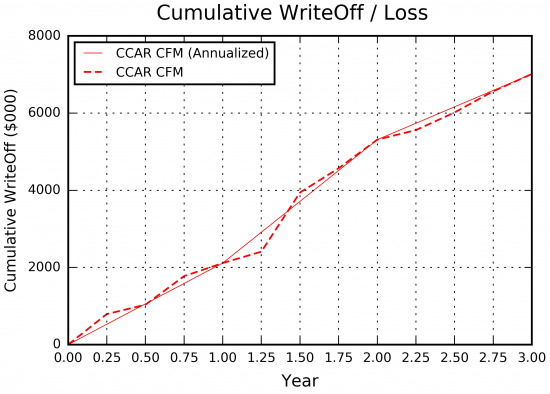

At a portfolio level, the new model gives very similar results to the full model. The graph below illustrates a portfolio's cumulative loss, quarter by quarter, for the CCAR stress, comparing the quarterly losses with the average losses from annual time steps.

At this time there is increased regulatory pressure for institutions to only use capital models that they control and understand in full detail - i.e., not to use vendor models that are 'black boxes'. For this requirement the CCAR CFM provides full transparency and is easily accessible to the institution's commercial real estate analysts through its simplicity and easily understandable risk calculations. The quarterly nature of the model allows both for simple set-up of relevant regulatory - or internal - stresses as well as direct reporting of all relevant metrics on quarterly time-steps. The underlying model is also presented in an Excel form so that all equations and assumptions can be understood, checked and modified if needed.

The quarterly nature of the CCAR CFM provides granular insight into how the institution's CRE portfolio will react to the very specific stresses detailed in the regulatory CCAR and DFAST stress-testing exercises (see above). Furthermore, by leveraging the full reporting capabilities of the SFS, the CCAR CFM also provides a detailed breakdown of various risk components (e.g. interest rate risk, lease risk, tenant risk and refinancing or term risk) at the portfolio or sub-portfolio level (see Dissecting CRE Loan Risks) along with easy identification of leading loss contributors within the portfolio.

Dr. Peter Andresén, Risk Integrated's Head of Methodology, commented that 'We are very excited to provide a quarterly cashflow simulation solution for CRE that will not only allow institutions to effortlessly meet the regulatory CRE reporting requirements but also provide insights into their CRE portfolio for additional business value'.

Risk Integrated's CEO, Dr. Chris Marrison, noted that modular nature of the SFS allows for the CCAR CFM to easily be slotted in alongside more a the more comprehensive SFS CFM thereby providing a comprehensive CRE solution for institutions that provides consistency across internal CRE grading and regulatory reporting: 'The comprehensive nature of the Specialized Finance System is clearly evident given the possibility of running several tailored analysis alongside each other, each providing specific insights'.

ENDS

About Risk Integrated

Since 2001 Risk Integrated has focused on developing and delivering the most comprehensive risk measurement and reporting tools for specialized finance. The Specialized Finance System (SFS) includes detailed cashflow simulation models in a robust secure system for managing the models, data and users. Risk Integrated's objective is to give each client a clear view of their current risk on outstanding loans, to properly assess the 'riskiness' of new deals in the pipeline, and to show how the risks can be profitably mitigated. The SFS is compliant with Basel III, CCAR and Solvency II.

Contact Risk Integrated today

Want to learn more about this article? Speak to our experts today.

Contact Us