Introduction

This paper describes a mathematically rigorous approach for defining market and credit stresses given a set of economic stresses. This approach is directly applicable to regulatory stress-test reporting.

Recent regulations such as CCAR and Basel III have adapted the long-standing risk measurement approach of stress-testing and made it applicable to new regulatory purposes. The current regulations require institutions to estimate losses in a base-case and in a stressed condition in which the condition is defined by stresses on a selection of macro-economic variables such as GDP and interest rates. A very direct estimate of the risk can then be obtained by using risk models that include economic and market conditions, for example regressions on historical default data where market conditions are included in the regressors1, or cashflow simulation where the cashflows are conditional on factors such as vacancy and rental rates. However, these direct approaches require the estimation of the remaining market conditions or credit factors that are not already specified in the regulatory stress.

Approach

As an example, consider the task of assessing the increased risk of loans to commercial offices in Pittsburgh, conditional on a set of regulatory stresses. Intuitively we know that if macro factors such as GDP are depressed, then market factors such as rents and vacancy rates will also tend to be worse. However, for any given level of GDP, the exact change in the market factors will be uncertain, e.g., if GDP was down 4%, rents might fall 10% on some occasions or 25% on others. More formally, defining the overall economic conditions removes much of the systemic risk, but leaves idiosyncratic risk2. The task then is to define the probability distribution of the market factors conditional on the fixed stressed levels defined for the economic factors.

The solution to this can be obtained by describing the interaction of the economic and macro factors using vector auto regression (VAR). The core VAR equation is as follows3:

Where:

is the level of the economic and market factors relative to the forecast at time

is the level of the economic and market factors relative to the forecast at time

is the matrix of regressions showing how factors at one time step affect levels at the following time step

is the matrix of regressions showing how factors at one time step affect levels at the following time step is the standard deviation of the exogenous shocks

is the standard deviation of the exogenous shocks is the transformation matrix describing how individual shocks commonly affect multiple economic and market factors

is the transformation matrix describing how individual shocks commonly affect multiple economic and market factors is a vector of Normally distributed exogenous shocks

is a vector of Normally distributed exogenous shocks

This equation can then be broken down and rearranged to separate the factors that are de-fined as being stressed from the factors that are still to be determined. In the arrangement below, E represents the set of stresses to the economic factors given by the regulators and M represents the change in the remaining market factors that are still to be determined.

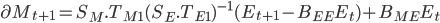

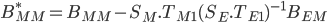

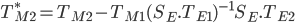

This can be rearranged to give:

where

Here

is an offset and along with

is an offset and along with  defines the new depressed central forecast for the market factors

defines the new depressed central forecast for the market factors defines the relationship between the market factors at one time step given the market factors at the previous time step and given that there are no remaining uncertainties from the economic factors

defines the relationship between the market factors at one time step given the market factors at the previous time step and given that there are no remaining uncertainties from the economic factors defines the correlation of the remaining shocks on the market factors

defines the correlation of the remaining shocks on the market factors

Results

The result of using this approach is that there are new depressed forecasts for the market factors and new probability distribution for the residual idiosyncratic shocks. Importantly, these residual shocks are correlated and the standard deviation of the shocks in the conditional case is less than in the unconditional base case. This means there is not double counting of depressed market forecasts plus full uncertainty on the market factors.

Graphically the effect is illustrated below. The first set of graphs shows the probability distribution of market factors in the stressed (conditional) case, compared with the distribution in the unstressed (unconditional) case4.

The graph below shows how the stressed scenarios are translated by the risk models into increased estimates of loss.

Given the limitations of historical data sets, there are some practical issues involved in the data analysis, but this approach has been used successfully in defining stresses to be used for regulatory reporting.

Conclusion

This framework gives a rigorous mathematical definition of how to define stressed credit and market scenarios conditional upon known stresses for economic factors. Although the equations are arithmetically complex, they are relatively easy to implement and point the way to correctly defining what is meant by a stress-test.

Contact Risk Integrated today

Want to learn more about this article? Speak to our experts today.

Contact Us- See Risk Integrated's paper: 'Linking Stress Tests to the Real Economy' ↩

- Here the term 'idiosyncratic' can have different meanings. If a national stress for commercial offices has been defined, then the idiosyncratic risk is only the variation of Pittsburgh and that particular building. However, if only general economic conditions have been defined with no direct definition of the stress in the CRE market, then the idiosyncratic risk also includes the overall variation of the CRE market. ↩

- This requires that the historical time series have been transformed to be stationary with normally distributed shocks. This can usually be achieved by using a mixture of transformations, such as taking out trends, taking logs and careful definition of variables, e.g., defining interest rates in real terms relative to inflation. ↩

- In this example we assume that the long run economic conditions after the initial stress are also defined, rather than reverting back to the unconditional case which has a wider distribution. One could also define the base case to be conditional, with no variation of the economic variables from their forecast. This would significantly reduce the risk in the basecase, but implicitly this is not what is meant by the regulators when they ask for the basecase. ↩