Introduction

Risk Integrated is pleased to announce that it will allow clients open access to its proprietary cashflow simulation risk models in a transparent Excel/VBA form without the constraints and formalities of the full Specialized Finance System (SFS).

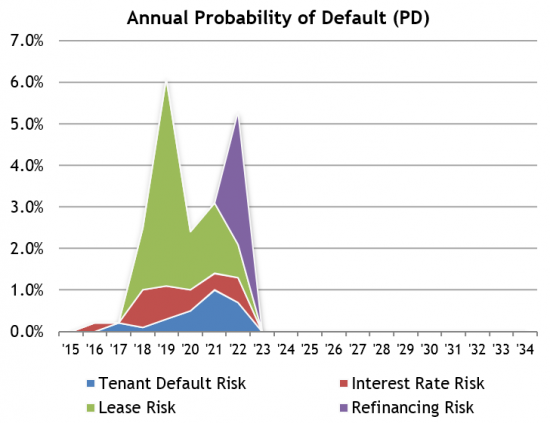

The models have been developed over twelve years and are currently being used for Basel capital, regulatory stress-testing and deal structuring across a wide variety of clients. The models use detailed Monte Carlo simulation to allow cashflows for IPRE and construction deals to be stressed in thousands of alternative scenarios including market movements, re-letting and tenant defaults. The results include a comprehensive suite of risk statistics including Probability of Default per Year, Loss Given Default, NPV of Loss, NPV of Income as well as all the financial ratios and line-by-line breakdown of expenses, income and debt service.

With the models in 'raw' Excel form users can assess the risk of individual deals in a transparent flexible framework on their desktop, making adjustments and developing the models as they see fit. After any desired adjustments, clients have the options to use their models in perpetuity, implement them in their own systems, or implement them using the full SFS. The SFS is a web-based system providing control of the models and an interface for the concentration of comprehensive deal and portfolio data into a single SQL database. The full system allows access by hundreds of lending teams and allows portfolio users to run batch analyses without needing additional input from the lending teams.

By releasing these models in a 'raw' Excel form, Risk Integrated is looking to provide analytics and services to clients who want models tailored to their business and to their experience but who do not want to develop their own models from scratch, and who do not necessarily want to adopt a full risk management system at this stage.

For more information please visit the Specialized Finance System product page or contact Chris.Marrison@RiskIntegrated.com.

Contact Risk Integrated today

Want to learn more about this article? Speak to our experts today.

Contact Us